Dogecoin Crypto Review

Dogecoin is a decentralized, peer-to-peer digital currency that enables users to easily send money online. Created by software engineers Billy Markus and Jackson Palmer, Dogecoin was launched in December 2013. Initially started as a joke, it quickly garnered popularity due to its light-hearted nature and the Shiba Inu dog meme that served as its logo. The coin’s launch was meant to satirize the wild speculation happening within the cryptocurrency space at the time. Despite its humorous beginnings, Dogecoin has evolved into a widely recognized digital currency, boasting a dedicated community and a substantial market capitalization.

Dogecoin operates similarly to Bitcoin and other cryptocurrencies but differentiates itself with a more approachable and friendly image. Its community is known for supporting charitable causes and funding various events. Over the years, Dogecoin has also found its way into numerous internet tipping platforms, where it is used to reward content creators. This usage has helped the cryptocurrency maintain relevance and expand its user base, making it one of the more popular alternative coins available today.

What Technology Was Dogecoin Created On?

Dogecoin was built using the same foundational technology as Bitcoin, known as blockchain. This technology ensures that all transactions are securely recorded on a decentralized public ledger, making them transparent and tamper-proof. Dogecoin’s blockchain operates on a proof-of-work (PoW) consensus mechanism, where miners solve complex mathematical problems to validate transactions and add them to the blockchain. This system helps maintain the security and integrity of the network.

Unlike Bitcoin, which has a capped supply of 21 million coins, Dogecoin has an unlimited supply. This inflationary model was implemented to ensure that there would always be enough coins in circulation, thereby maintaining liquidity and encouraging the spending of Dogecoin rather than holding it as an investment. Another notable difference is Dogecoin’s block time, which is just one minute compared to Bitcoin’s ten minutes, allowing for faster transaction confirmation. These technological differences have positioned Dogecoin as a more user-friendly and accessible alternative to other cryptocurrencies.

How Stable is Dogecoin?

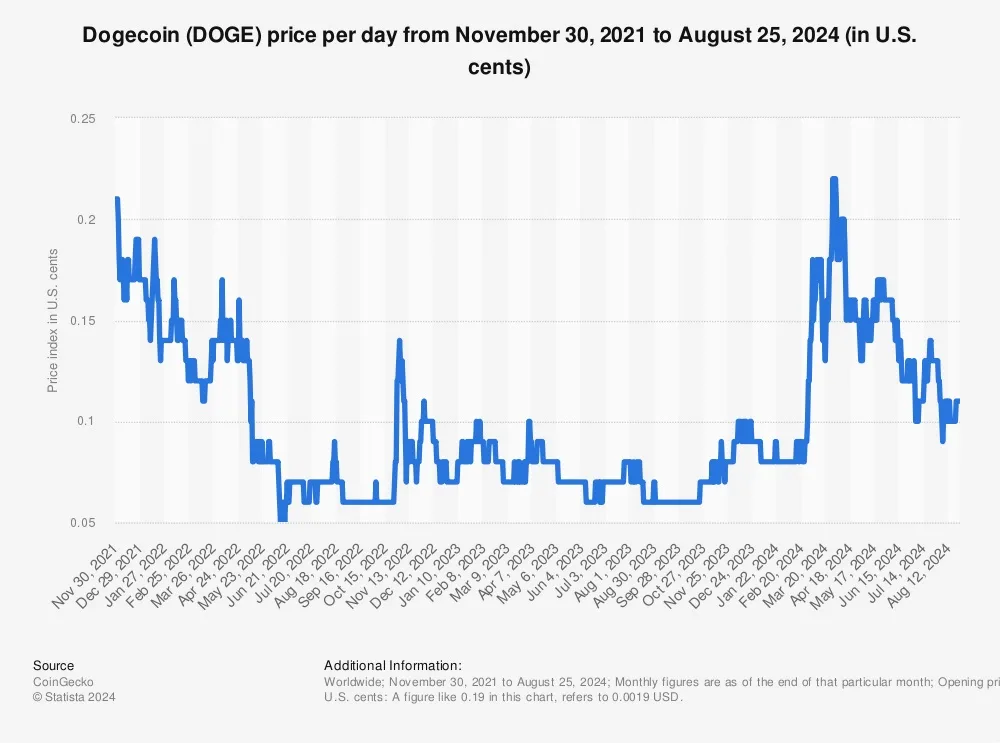

The stability of Dogecoin, like most cryptocurrencies, is subject to market forces and investor sentiment. As a highly speculative asset, Dogecoin has experienced significant price volatility. Factors such as social media trends, endorsements from high-profile individuals, and general market conditions can cause drastic price swings. For instance, public endorsements from influential figures like Elon Musk have led to rapid price increases, while market corrections have similarly seen its value decline sharply.

Despite these fluctuations, Dogecoin has managed to maintain a stable presence within the cryptocurrency market, partly due to its large and loyal community. The currency’s resilience is also supported by its widespread use for tipping and donations, which helps to stabilize its value to some extent. However, potential investors should be aware of its volatility and consider their risk tolerance when deciding to invest in Dogecoin.

What Major Markets is Dogecoin Listed On?

Dogecoin is listed on numerous major cryptocurrency exchanges, making it easily accessible to investors worldwide. Among the most prominent exchanges that offer Dogecoin trading are Binance, Coinbase, Kraken, and Robinhood. These platforms allow users to trade Dogecoin against other cryptocurrencies such as Bitcoin and Ethereum, as well as fiat currencies like the US dollar and Euro. The wide availability of Dogecoin across these exchanges has contributed to its liquidity and popularity among traders.

The listing on major exchanges also means that Dogecoin benefits from robust trading infrastructure, including advanced security measures and high liquidity, making it easier for users to buy, sell, and trade the cryptocurrency. This accessibility and ease of use have helped Dogecoin remain one of the most popular and widely traded cryptocurrencies in the market.

Is it Worth Investing in Dogecoin?

Investing in Dogecoin comes with its own set of risks and rewards. On one hand, Dogecoin’s large and active community, combined with its mainstream recognition and frequent media attention, provide it with a strong foundation and potential for growth. The coin’s frequent use in tipping and charitable initiatives also reflects a practical application, adding to its utility and attractiveness as an investment option.

However, potential investors should be cautious of Dogecoin’s volatility and the speculative nature of the cryptocurrency market as a whole. While Dogecoin has seen significant price increases, it has also experienced sharp declines, which can lead to substantial financial losses. Therefore, it’s essential for investors to conduct thorough research and consider diversifying their portfolios to mitigate risks.

Ultimately, whether Dogecoin is a worthwhile investment depends on individual risk tolerance and investment goals. Those looking to participate in the crypto market and who are comfortable with volatility might find Dogecoin a compelling choice, while more conservative investors may prefer more stable and less speculative assets.

Popular

-

Pasino Online Casino Review

Pasino online casino is a popular gaming platform that offers …

-

Blockchain in Insurance: Automating Payments and Risk Management

Blockchain is one of the most promising technologies of our …